ETI Excel Template Program for Microsoft Excel Windows Desktop

Do you need to calculate South African Employment Tax Incentives (Youth Employment) or just want a way to easily check your ETI payroll calculations?

If you have Windows Excel and require a tool to just calculate ETI then seriously consider this program, (or look at LabourTools desktop app)

ETI Version 5 now includes the March 2022 calculations as well as prior year calculations

Features:

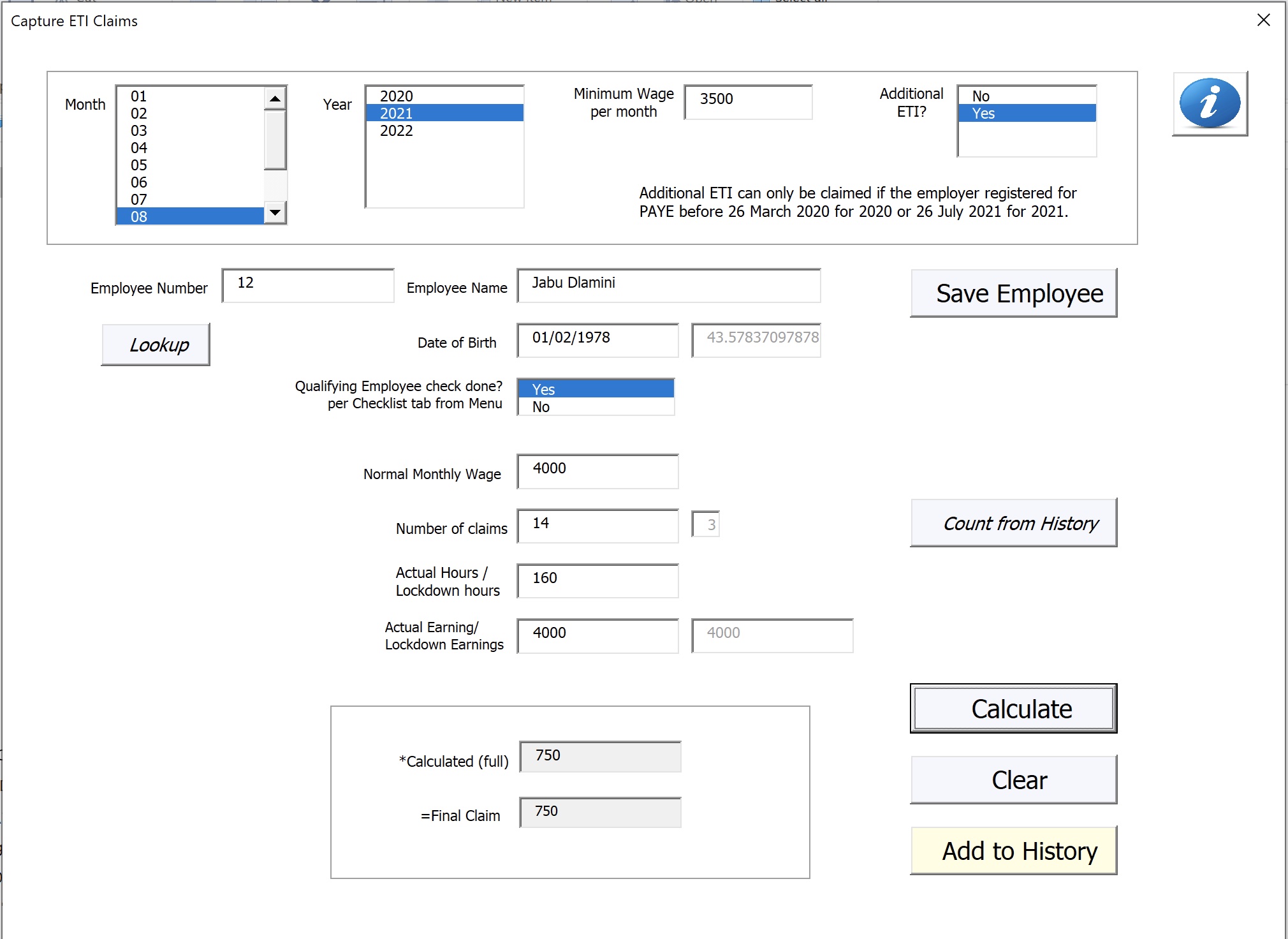

- Save employee details so that it is easier to capture future claims.

- Capture the earnings and hours and click on Calculate to see the value of the claim.

- If the input values do not comply with the SARS employee requirements, then a message will appear and a value will not be calculated.

- Save the calculation by clicking on the Save button if you want to keep history.

- If calculations are saved, the number of claims can be looked up for future claims. The lookup is done automatically by a press of a button.

- The number of claims is important because the number of claims determine what calculation to use. There are three calculation groups:

* Cycle 1 for 1 to 12 months

* Cycle 2 for 13 to 24 months

* Cycle 0 for Covid Relief 2020 and August to November 2021 extended calculations

- CoVid Relief calculations are automatically applied - you don't have to do anything other than to calculate for staff over 29 years of age and earned/"deemed to have earned" less than R6500 per month.

- Import or capture Employees directly in the Employee tab if you don't want to use the Form each time.

- Import or capture ETI History directly in the ETI History tab if you don't want to use the Form each time.

- Use the ETI History Tab for SARS Easyfile submission records. The fields are setup according to the BRS Spec that is why month is 01, 02, 03 etc REMEMBER to save only valid calculations so that your count of calculations is correct - and not counting zero calculated claims.

- One program/spreadsheet for all your ETI calculations.

- If your payroll software calculates ETI you can use this calculator to check the calculations. You don't need to first save employees or history -just type in the fields, click Calculate and see the results.

- The program checks that the age, income is allowable and works out the 160 hours equivalent earnings if the hours worked amount is less than 160 hours. It even checks the number of claims and allows for the extra 8 claims for CoVid relief in 2020 and August - November 2021 extended rules. NB. Only save valid claims to history so that the count of existing claims is accurate. Do not save zero calculations.

- Use the Checklist Tab to make sure you have complied to the Employer requirements.

- Our Consultants use this tool to check our systems and to audit the outsourcing payroll calculations.

Installation:

Installation is easy. Place your order here, pay and then go to the downloads section after you login again and download the ZIP file.

Un compress the file first before running it.

The SHA 256 Checksum for the Zip file is:

C7718D63DBE954594C9CCFC6C9513346688346769B3CEB3E6C653A2B4FC10897

The SHA 256 Checksum for the EXE file is:

1FA31D9851E7107930EB150DB841ABA64B6EDFC3ADFFB92133C98346E1A8588E

The software will need an unlock key that is provided by sending the code generated to codes@payslip.co.za as instructed in the installation screens.

The extension of the file will always be .exe and not .xlsm or .xls because it is a compiled program that uses Excel.

The first time you save an employee or claim, the relevant sheets and headings will automatically be created.

Software Requirements:

Windows operating system and Microsoft Excel 64 bit Windows system Stand alone PC , Not Network compatible

The purchase of this software is limited to one desktop computer only (local drive - not network). The unlock key will only allow access on a specific computer or one virtual drive.

HELP AND SUPPORT

If you need assistance or would like help with calculating ETI historically or reconciling Emp201's, please contact help@payslip.co.za so that we can setup a consultation booking at a suitable time.

We look forward to your feedback and if you have any recommendations for the next version, please let us know.

Payslip has products and services to help employers of all sizes and industries with their payroll and HR requirements. Contact us if you would like to discuss the options available.

NOTE:

This tool is only available for existing clients or organisations that do not charge for this service (eg payroll consultants/outsource providers, accountants, auditors)

E&OE Excepted, calculations based on SARS examples and BRS documentation